Aaron Johnson, Treasurer

937-349-9000 ext. 1203

Jessica Rausch, Accounts Payable, EMIS

937-349-9000 ext. 1209

Tessa Lerch, Payroll, HR

937-349-9000 ext. 1204

Fairbanks Forecast November 2023

Public Records Requests should be emailed to Aaron Johnson, Treasurer

TREASURER'S OFFICE

The Fairbanks Local School District received the Auditor of State Award for the 2022 fiscal year!

FEDERAL FUNDING

Fairbanks is applying for federal funds for Title I, Title II-A, IDEA, and Early Childhood. Public input on how those funds will be expended is welcome.

Financial Update 2023:

The operational financial health continues to be very stable for the Fairbanks Local School District. Stability is within a 3-year projected time frame. The state finalized a 2-year biennial budget this summer, and fortunately kept our state funding stable, with a 2% and 3% increase in our state funding for the next two years. Our local revenue continues to be stable with continued economic growth (Property and Income) from valuation updates and new construction. The renewal of our "substitute" emergency levy recently has put the district on a continued path of stability. Federal grant funding (ESSER) has provided additional resources through 2024. This funding is mostly tied to student learning with a portion put towards facility upgrades.

So what about the long term? The longer term is always much harder to project. Our State Funding still has not been settled long term with a current phase in of a new funding formula. Our state funding will most likely remain the same over time, unless there is much more student growth in the district. The financial condition of the State plays a role in our funding. So we continually have to watch where the state is financially. The economy moving forward will impact the district financially. Income and property tax both move with the local and state economy.

The expenditure side of district operations obviously plays a role in our financial future. Student, staffing and facility needs come into play.

In summary, we continue to feel good about the short term financial health of the district. The local and state economy, inflation, and how our state funding continues will ultimately impact the long term financial health of the district. The district continues to strive in meeting the needs of the students and district while being responsible to the district taxpayers.

FUNCTIONS OF THE TREASURER'S OFFICE

Accounts Payable

Accounts Receivable

Auditing

Banking

Benefit Administration

Budgeting

Business Management

Contract Management

Asset Management

EMIS

Financial Reporting

Forecasting

Grants Management

Investing

Payroll

Records Management

Student Activities

HOW ARE SCHOOLS FUNDED?

School funding starts with the State's premise of a shared responsibility between them and the local community.

Schools typically have to pass levies to help fund operations and improve buildings.

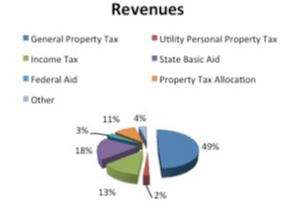

REVENUES

General Property Tax includes Residential, Agricultural, and Commercial property located in the district. General Property Tax for operations is levied at approximately 26.6 mills, with 20 mills being unvoted minimum collected by law, and voted (now "substitute") emergency operating levy of 6.6 mills. Emergency levy brings in $1,679,000 per year for operations. This is a five-year levy that was renewed in 2018. There is also debt millage for the elementary outside of operations at approximately 3 mills.School funding starts with the State's premise that funding is a shared responsibility between them and the local community. The State provides some basic aid funding, but then relies on local communities to provide the remaining necessary funds. How much State aid we receive typically is a function of the number of students and property wealth per the number of students in the district. Schools would not be able to provide the services and programs without local support. Below is a current breakdown of Fairbanks district revenues. Property tax allocation would be considered State Assistance.

Income tax is .75% for operations. There is also a separate .25% income tax for permanent improvements only. Permanent Improvement levy is for 5 years with a current expiration in 2021. Permanent Improvements are tangible assets or improvements to facilities/buildings.

Property Tax allocation includes a 12.5% Homestead/Rollback the state pays on behalf of home owners.

Permanent Improvements

Recent permanent improvements to the district include:

New flooring and ceiling tile in the Middle School

New Lockers in the Middle School

Masonry and joint repair in the Elementary School

Bleacher repair

Pavement repair at the schools and bus garage

Propane bus

Classroom furniture

HVAC in the weight room

Bus Garage roof

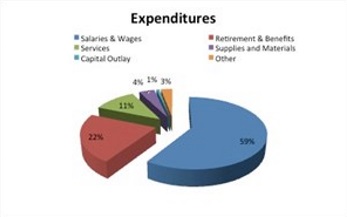

EXPENDITURES

STUDENT WELLNESS AND SUCCESS FUNDING

District Safety Coordinator

District Psych. Services

STAFFING

Since schools are service organizations, approximately 75-80% of the budget goes to personnel staffing (Salaries, Wages, Benefits). We have 118 full and part-time staff members made up of Teachers, Bus drivers, Maintenance and Custodial, Support staff, and Administration.

SERVICES

Bus repair services

Copier Leases and Printing

County Auditor/Treasurer Fees

Instructional Support Services and Professional Development

Legal

Maintenance Repairs and Contract Services

Special Education Services (Physical Therapy, Occupational Therapy, Psychologist)

Technology Services

Tuition to other schools for Special Education, Community, and Charter Schools.

Utilities, Heat (Natural Gas), Electric, Phone

SUPPLIES

Bus parts and supplies

Cleaning and Maintenance Supplies.

Diesel fuel for bus transportation

Instructional Materials and Textbooks

Technology Supplies

CAPITAL OUTLAY

Buses

Classroom Furniture

Major Building Improvements/Upgrades

Maintenance Equipment

Technology Equipment